The pandemic has brought about many changes for Americans, including where they shop and how they spend their time and money. As we look to the future, and a time when life goes back to ‘normal’ post-pandemic, we predict that a few of the shopper behavior changes that have been brought on by the pandemic are here to stay. This blog discusses two of those changes which are where and how consumers grocery shop.

A shift in where grocery shopping is done

With the onset of COVID, many Americans feared catching the virus and turned to online grocery shopping (pickup or delivery) to avoid exposure. Prior to the pandemic, Americans reported that 75% of their grocery shopping was done by walking through a retail store and 25% was completed online using pickup or delivery. As of July, these numbers flipped by 15 points with percentage of shopping done in store to 60% and the percentage of shopping done online at 40%.

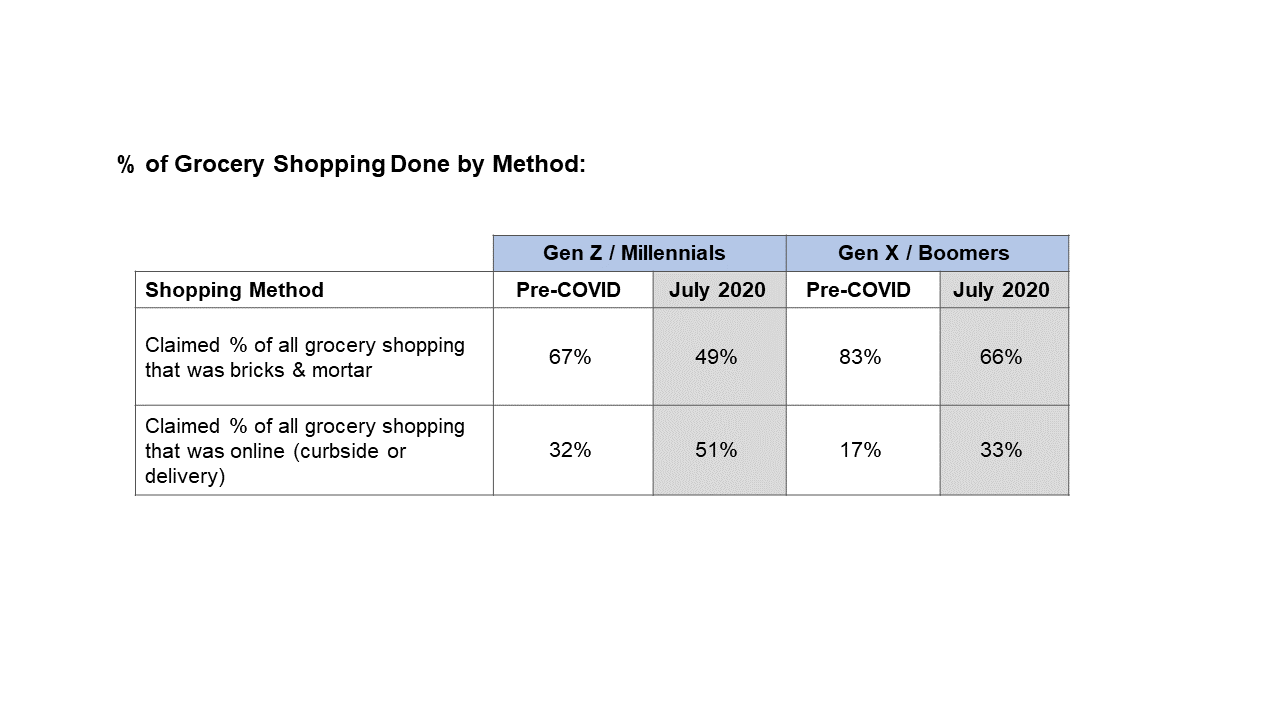

It is even more interesting to examine shopping trends by generation. What we see is that younger consumers are significantly more likely to report that they are doing shopping online both before and during the pandemic. As of July, Gen Z and Millennials report that 50% of their grocery shopping is being done online, up 21 pts prior to COVID. As the pandemic exposes more digitally native shoppers to the convenience of pickup/delivery and grocery retailers improve this experience, it’s unlikely that younger shoppers are going to go back to their old shopping methods. For them, online grocery shopping is here to stay.

While more mature Gen X and Boomers report a lower overall share of online purchasing (33% vs 50% for younger shoppers), the rate of change among this generation is high; their share of online purchases doubled from 17% to 33%. While it is likely that much of this volume will return to normal post-pandemic due to ingrained habits, older consumers will undoubtedly feel they have more options than in the past. As a result, their loyalty share of wallet to their preferred grocer may soften, unless that grocer provides the full array of shopping options through click to pick up and delivery.

A shift out of autopilot shopping

Another way the pandemic impacted grocery shopping is by limiting supply. Whether it was driven by production shortages or through the initial stock up surge by panicky consumers, shoppers found the shelves in many popular categories empty and frequently experienced out of stocks on their ‘go to’ products and brands.

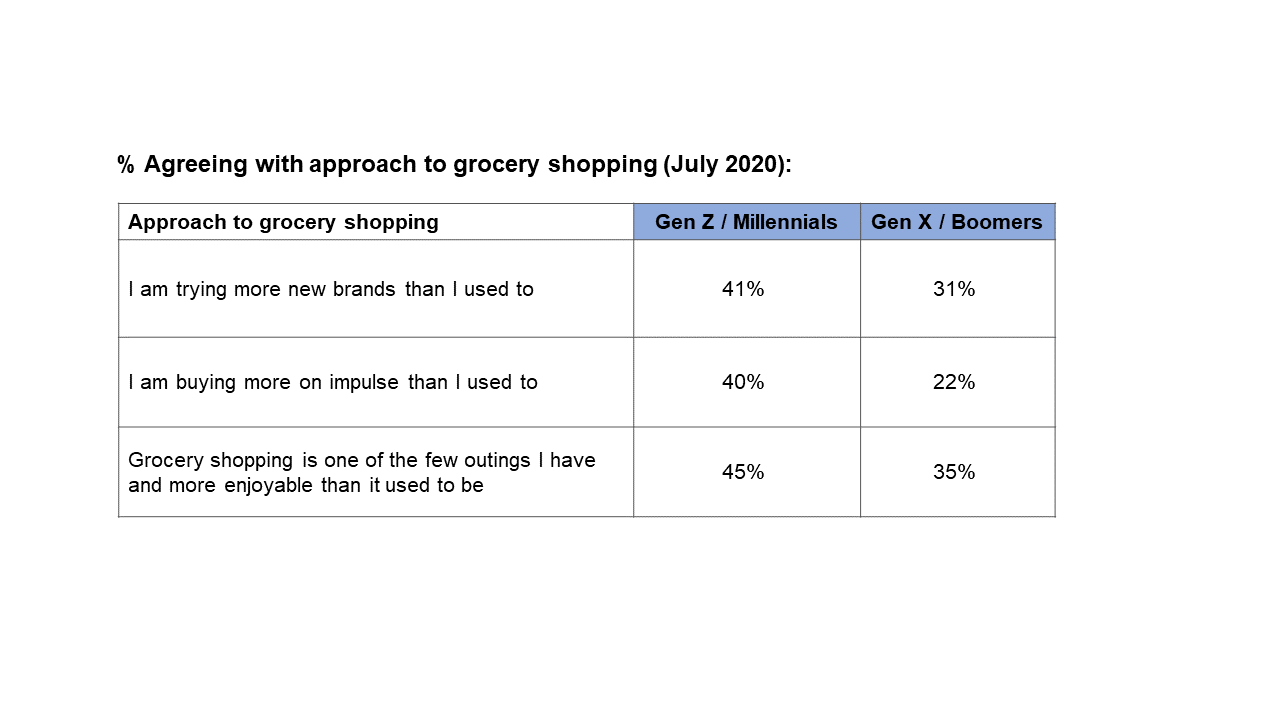

Because of this shortage, consumers were forced to go off autopilot and evaluate their choices anew, finding substitute brands or products. In July 2020, 35% of Americans report they are buying more new brands than they are used to and 29% of Americans report they are buying more on impulse than they used to before COVID.

Again, looking at this by generation shows an even bigger change. Younger consumers are significantly more likely than older consumers to report that they are buying more new brands than they used to (41% v 31%) and buying more on impulse than they used to (40% v. 22%).

It’s been long known that Millennials have driven demand for more transparent, better-for-you practices which has driven emerging brands. Combine this with the fact that consumers are doing less shopping in-store and report they find grocery shopping more enjoyable than it used to be (39%) and what we may find when shoppers go back to the store – and can enjoy a pandemic-free stroll – is that they’re going to spend more time browsing and finding new products than they did before.

An opportunity to capture new shoppers

As consumers adapt to their new routines – during and after the pandemic – there will be lasting changes in their shopping behaviors, providing retailers and brands real opportunity to capture new buyers with this disruption in where and how consumers shop. This presents an opportunity to capitalize on your new, post-pandemic buyers to understand what causes them to choose you. How do they find you? What message, claims, and packaging cures inspire them to give your brand a shot? At Linkage, we’ve helped our clients tap into their email and social databases to identify what’s happening to drive business growth and develop strategies to help sustain it in a post-pandemic world. If we can help you, contact us at info@linkagereserach.com or visit https://linkageresearch.com

All of the data referenced in this blog comes from a large-scale study fielded by Linkage Research with 1,000 nationally representative consumers in July 2020. If you are seeking insights about how your consumer’s behavior or attitudes have changed due to COVID, Linkage offers data mining, custom research, and innovation workshops grounded in trends.