April 17, 2019

The Millennial desire for transparency and natural has shaken up the food industry and now they are leading the way for a similar change in the beauty industry. Millennials believe that the products they put on their skin can impact their health and they are seeking the same clean label transparency in beauty products. Their purchase behavior supports this – 40% of Millennials report increasing their purchases of natural skin and hair care products in the last year. In Part I of our natural beauty series, we share insights about how Millennials are shaping the beauty industry.

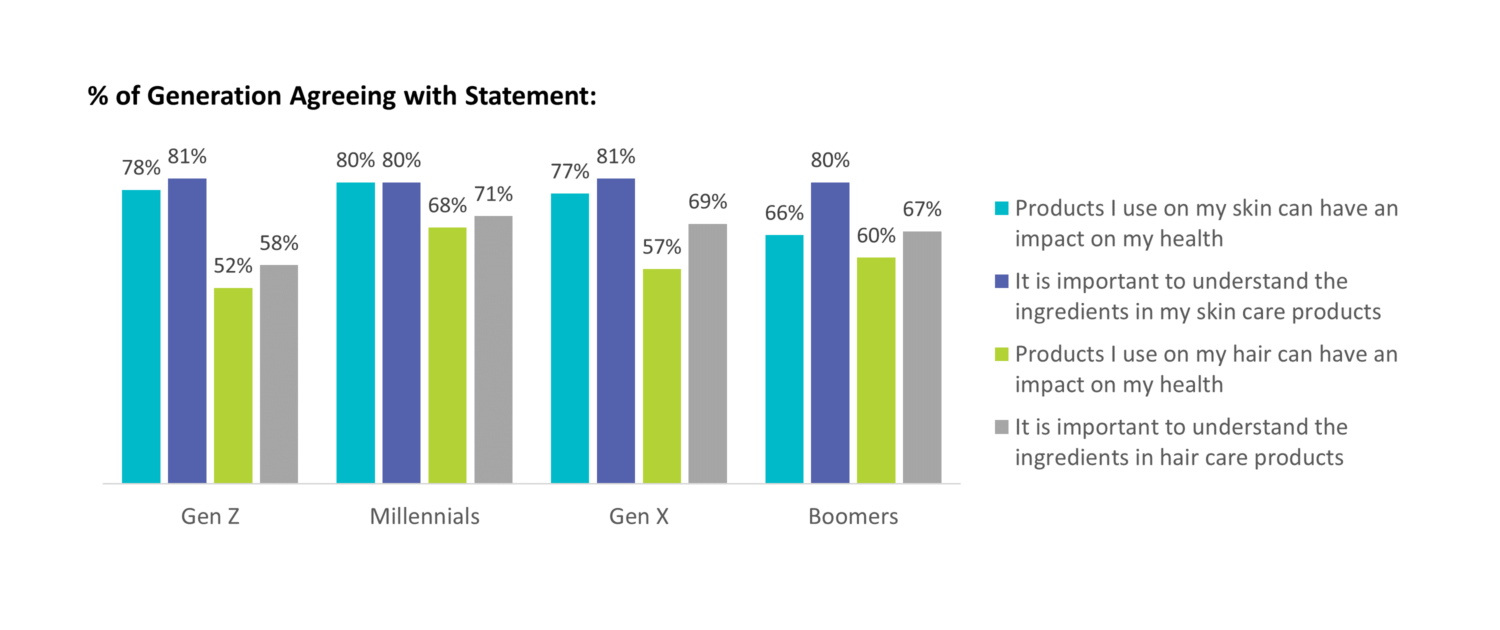

1. THEY BELIEVE PRODUCTS THEY USE ON THEIR SKIN CAN IMPACT THEIR HEALTH

The Millennial generation has made a clear connection between their skin as an organ and their overall health. More than any other generation, Millennials believe that products that they use on their skin and hair can impact their health and well-being. Given the overall importance they place on health, Millennials want to know what’s in the skin and hair care products, and they are reading labels to find out.

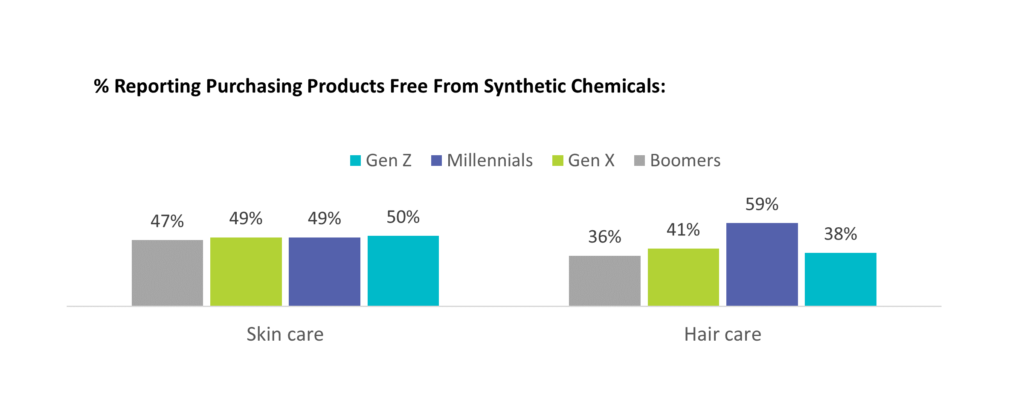

2. THEY ARE PURCHASING BEAUTY PRODUCTS FREE FROM CHEMICALS

Although the US government hasn’t regulated the beauty industry yet, Millennials are driving change by buying beauty products that are free from chemicals that concern them like parabens, silicones, and sulfates. Nearly half of Millennials report that they are currently buying a skin care product free of synthetic chemicals and 59% report purchasing hair care products free of synthetic chemicals.

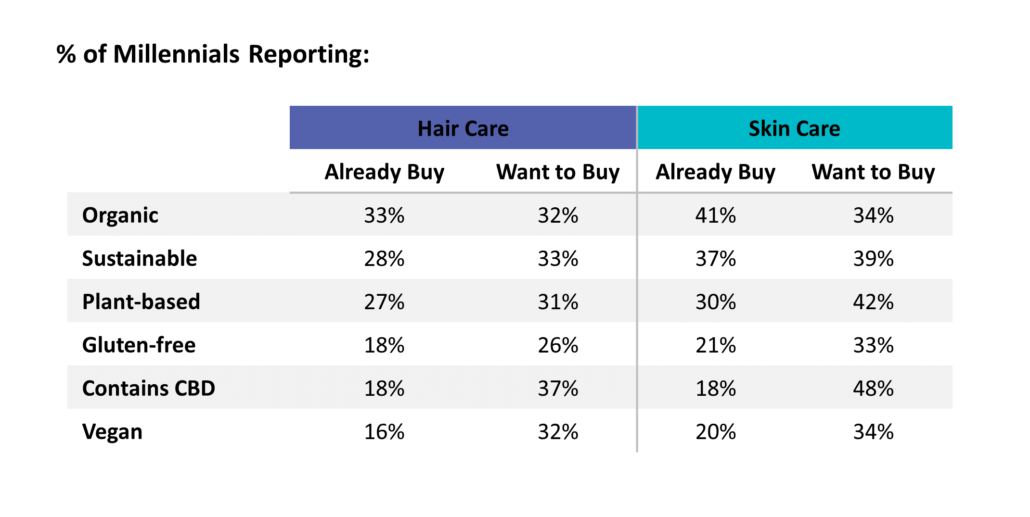

3. THEY ARE SEEKING ORGANIC, SUSTAINABLE, AND PLANT-BASED BEAUTY PRODUCTS

Organic, sustainable, and plant-based have been a growing trending in food and Millennials are fueling the growth for these same attributes in beauty products as well.

Nearly a third of all Millennials report they are already buying hair and skin care products with organic, sustainable, or plant-based attributes. Over another third of Millennials report they aren’t buying hair and skin care products with these attributes today, but want to in the future. When it comes to trending ingredients, CBD is one to watch in skin care as 48% of Millennials report they want to buy products with this ingredient.

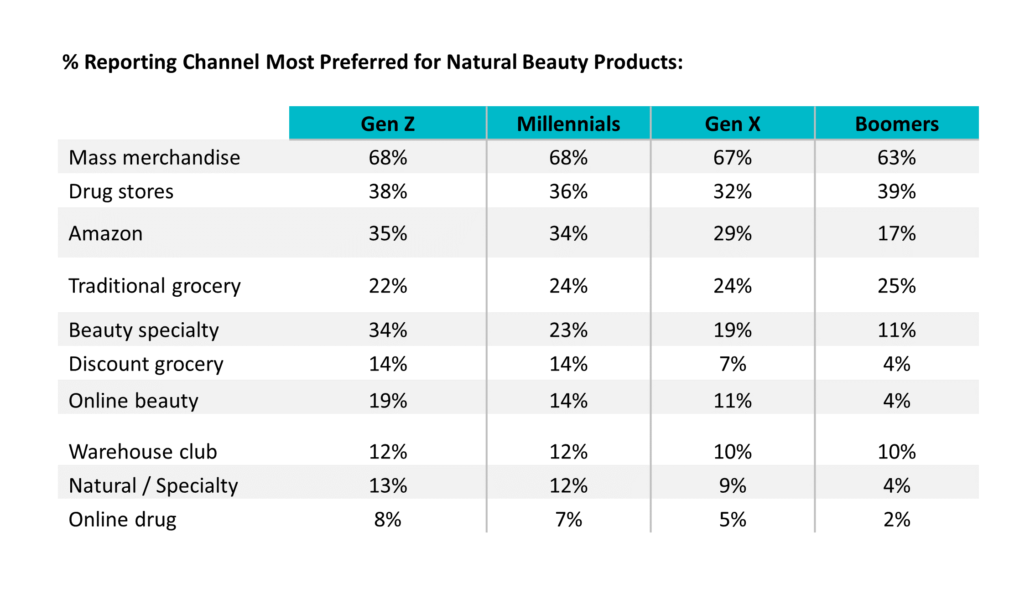

4. THEY ARE SHIFTING THEIR SPEND TO RETAILERS WHO HAVE A NATURAL BEAUTY ASSORTMENT

While mass and drug remain top channels for shopping for beauty products like skin and hair care, we are seeing Millennials shift their spend to other channels to fulfill their beauty needs. Millennials, and Gen Z, report that they shop more channels on average than their generational counterparts and are significantly more likely to prefer shopping for beauty through Amazon, beauty specialty (Sephora, Ulta), online beauty specialty, and natural/specialty grocery.

IMPLICATIONS FOR BEAUTY BRANDS

To capture the wallet of the Millennial beauty consumers, brands and retailers should:

- Evaluate the ingredient list on beauty products and ensure it is free from the synthetic chemicals Millennials are trying to avoid.

- Consider a benefit and claims strategy that highlights the free from attributes of the brand for Millennials.

- Review innovation strategies and plans against the list of attributes that Millennial consumers are seeking most in beauty, including organic, sustainable, and plant-based. As the industry evolves, consider the role of CBD in products.

- Leverage messaging and promotional strategies featuring free from, clean label, and natural to capture natural beauty seeking Millennials at mass and drug, where they shop most. Evaluate the distribution opportunity online and in the natural / specialty channel where Millennials are shifting spend of wallet.

For more insights, see Linkage’s in-depth report on the natural beauty consumer at https://linkageresearch.com/product/natural-beauty-deep-dive/

All data reported in this article was sourced from a large-scale internet study fielded by Linkage Research from January – March 2019. The study consisted of 1,001 US representative consumers, 998 consumers who reported purchasing a hair care product and 886 who reported purchasing a skin care product in the last year.

2019

2019 2019 Linkage Research

2019 Linkage Research