For years eating a plant-based diet has been seen as restrictive through the lens of vegan which includes the principles of eliminating all animal products in every form (meat, dairy, eggs, honey). With the recent rise of plant-based diets and explosion plant-based food offerings, more Americans are finding this as a flexible way to add more plants to their diet without the restriction of veganism. In this article, we look at the differences and similarities between the vegan and plant-based consumer and implications for brands looking to capture the growing demand for plant-based alternatives.

WHO IS CHOOSING A VEGAN DIET VERSUS A PLANT-BASED DIET?

While vegan is niche with only 7% of households reporting they follow a vegan lifestyle, plant-based appeal is broader. In 2019, 16% of households report it is important to choose foods that are plant-based.

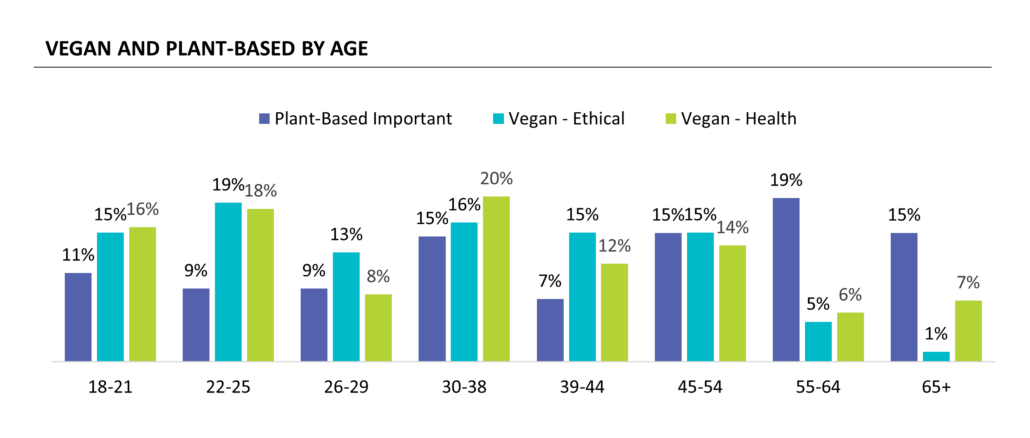

Vegan lifestyles tend to be adopted at a younger age, with 60% reporting a vegan lifestyle under the age of 40. The adoption of a vegan lifestyle is typically motivated by a specific health condition or a strong belief in the ethical treatment of animals and the planet. Vegan consumers educate themselves on health and know the short and long term benefits of adopting a vegan diet. Those choosing to be vegan for health reasons over index among men (57%) while adoption for ethical reasons is more consistent among genders. African-Americans and Hispanic consumers over index accounting for nearly 50% of the vegan population and are doing this primarily to support their health.

In contrast, consumers who believe a plant-based diet is important tend to span generations. And adults 55+, who have the lowest adoption of a vegan lifestyle (11%), have a high adoption of plant-based eating with 34% of plant-based consumers falling into the age group. Plant-based consumers are more likely to be women (54%) and here again we see an over index among the African-American, Hispanic, and Asian population which account for nearly 40% of plant-based consumers.

The main motivation for adopting a plant-based diet are health related, such as an allergy/sensitivity to foods, desire to loose/maintain weight, control blood pressure, and the overall belief that plant-based diets are better for your health.

WHAT IS MORE APPEALING: PLANT-BASED OR VEGAN CLAIMS?

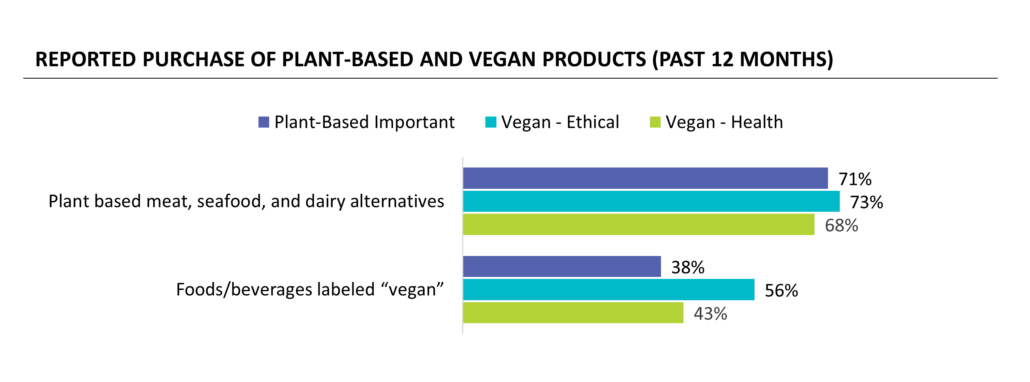

While products with plant-based claims are widely appealing among the plant-based consumer and both vegan groups, the appeal of products with vegan claims do not have the same broad appeal. Only 38% of plant-based consumers and 43% of health vegans report buying a vegan product in the last year. The ethical vegan consumer is the biggest consumer of products with vegan claims, with 56% reporting they purchased this type of product in the last year. This speaks to the strong belief ethical vegans have behind their choice and the support they give brands that hold these same values.

The lower appeal of products with vegan claims among the plant-based consumer and health vegan may be a factor of the perceived taste appeal of these products or the availability of these products on a typical shopping trip. Plant-based consumers are shopping traditional channels like mass (75%) and grocery (73%) where vegan hasn’t historically been a focus category. Compare this with vegans who are significantly more likely to shop alternative channels like Amazon Fresh (52%) and Natural/Specialty Channels (37%) where they can find a wider assortment of vegan options to meet their needs.

WHICH CONSUMER SEGMENT IS FUELING PLANT-BASED GROWTH?

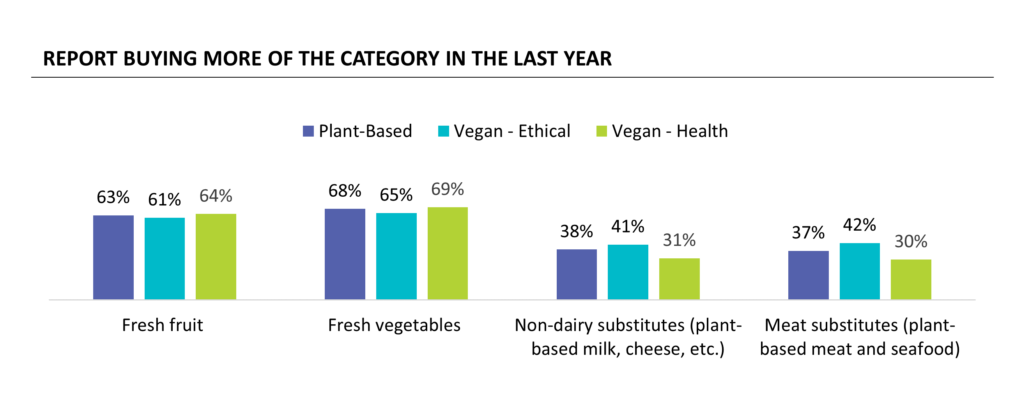

All three consumer segments are fueling plant-based growth across fresh produce and meat and dairy substitutes. 60%+ of plant-based consumers, ethical vegans, and health vegans report buying more fresh produce (fruit and vegetables) than a year ago. All three segments also report increasing their purchase of plant-based substitutes, including meat and dairy. Ethical vegans are leading the way with 40%+ reporting they have bought more of these categories in the last year. This poses an interesting dynamic for CPG brands that will need to cater to the needs and beliefs of each of these groups fueling plant-based growth.

IMPLICATIONS FOR BRANDS

As manufacturers look to enter and evolve their offerings in this space, the insights from this data provide the following implications:

- Vegans and plant-based consumers are fueling plant-based alternative growth. To maximize potential sales among these consumers, brands should look to optimize the appeal of products through plant-based claims and appealing taste profiles while providing reassurance to the ethical vegan consumer that the product is vegan through certification and, where applicable, rooted in the causes they believe in.

- With health and allergy/sensitivity being a top motivator for vegans and plant-based consumers, brands should look to promote the health benefits of the plant-based alternative and provide reassurance of what these products are free from for those consumers who are avoiding for an allergy or sensitivity.

- With the expanding appeal of plant-based eating and the general belief its better for your health, vegan brands have an opportunity to attract more consumers through appealing packaging and products and expanded distribution to capture more of the growing plant-based market.

- Brands with a purpose should maintain the vegan certification as it is important to the ethical vegan consumer.

If you need more insights about the plant-based or vegan consumer or want to test your product concept among these groups, contact Linkage Research at info@linkageresearch.com or review our syndicated reports at www.freefromforum.com/reports/.

All data reported in this article was sourced from a large-scale internet study fielded by Linkage Research from January – March 2019. The study consisted of 3,001 US representative consumers, 208 consumers who reported following a vegan lifestyle, and 485 who reported eating plant-based was important

2019 Linkage Research

2019 Linkage Research